Total nonsense, strangers on the internet. Who the hell even writes this crap?

Pay no mind to the man wearing no shoes, screaming in the park…

Or, let’s bust out the Reynolds Wrap and cover that dome! … We’re goin deep, lets bottom of the pool…

The $10.7 Billion Question: When Your President’s Crypto Holdings Meet Foreign Policy

Three weeks after inauguration, Trump signed an executive order creating a Bitcoin strategic reserve. Three weeks before that? Foreign governments wired $2.5 billion into his family’s crypto ventures. Coincidence?

The Setup

You’re scrolling through ethics disclosures and stumble on something wild:

The sitting President of the United States has nearly half his net worth tied up in cryptocurrency ventures—while simultaneously controlling the regulations that determine whether crypto lives or dies in America.

Sound crazy? Let’s lay it out.

-World Liberty Financial (WLFI) raised $2.5B for its “anti-CBDC, pro-freedom” DAO token (WLFT), while quietly launching the USD1 stablecoin

– Donald Trump received $390M+ in direct token compensation

– TMTG ETF filings proposed exposure to BTC, ETH, XRP, and more

– Trump memecoins raised over $150M and are fully controlled by campaign-adjacent insiders

– Trump Jr. invested in **Thumzup**, a project pitching itself as the next “Bitcoin treasury tool for small business”

– Eric Trump co-founded “American Bitcoin”, raising $220M for a Hut 8-powered mining platform

– Eric Trump also joined Metaplanet’s advisory board, Japan’s public company clone of MicroStrategy, which now holds 5,555 BTC (worth ~$945M+)

Act I: The Family Business Goes Digital

World Liberty Financial didn’t just raise money — it raised $2.5 billion for a so-called “anti-CBDC, pro-freedom” initiative. But behind the patriot marketing, the mechanics get interesting:

Trump himself received $390 million in direct token compensationWhile blasting CBDCs, they launched USD1, a Trump-affiliated stablecoinEric Trump joined the advisory board of Metaplanet, Japan’s Bitcoin-holding MicroStrategy clone with 5,555 BTC(~$945M+)Don Jr. invested in Thumzup — branding itself a “Bitcoin treasury tool” for small business

The family wasn’t experimenting. They were building a monetary network.

Act II: The Commerce Secretary’s Side Hustle

Enter Howard Lutnick — Trump’s Commerce Secretary.

He doesn’t just dabble in crypto infrastructure. He custodies the core of it.

Tether (USDT): $86B+ in circulation — the backbone of global crypto volume

Custodied entirely by Cantor Fitzgerald, Lutnick’s company

Lutnick brags publicly: Tether’s reserves are “in Cantor’s hands”

His son Brandon Lutnick runs Twenty One Capital, a $3B Bitcoin fund—funded by Tether

So: The man in charge of U.S. trade policy controls the plumbing for most crypto transactions. And his son is plugged directly into it.

Act III: The Foreign Money Plot Twist

Remember that $2B investment into Binance from a UAE-based fund?

Here’s the kicker:

It was processed using USD1, the Trump-family stablecoin.

Let that sink in:

Foreign sovereign wealth (UAE)

Into the world’s largest exchange (Binance)

Using a presidential-family–issued stablecoin

Also connected? Justin Sun, currently under SEC fraud investigation, who just so happens to be a strategic advisor to World Liberty. His $75M buy-in to Trump crypto ventures? SEC case paused 75 days later.

Act IV: The Lightning Wildcard

Jack Mallers and Strike aren’t just helping people buy coffee with Bitcoin. They’re rewiring global money infrastructure.

Strike brought Lightning Network to El Salvador. Now it’s tied to Twenty One Capital’s SPAC, giving it a direct link into the Cantor–Tether–Trump pipeline.

While retail eyes the BTC price, these guys are replacing SWIFT and ACH rails under the surf

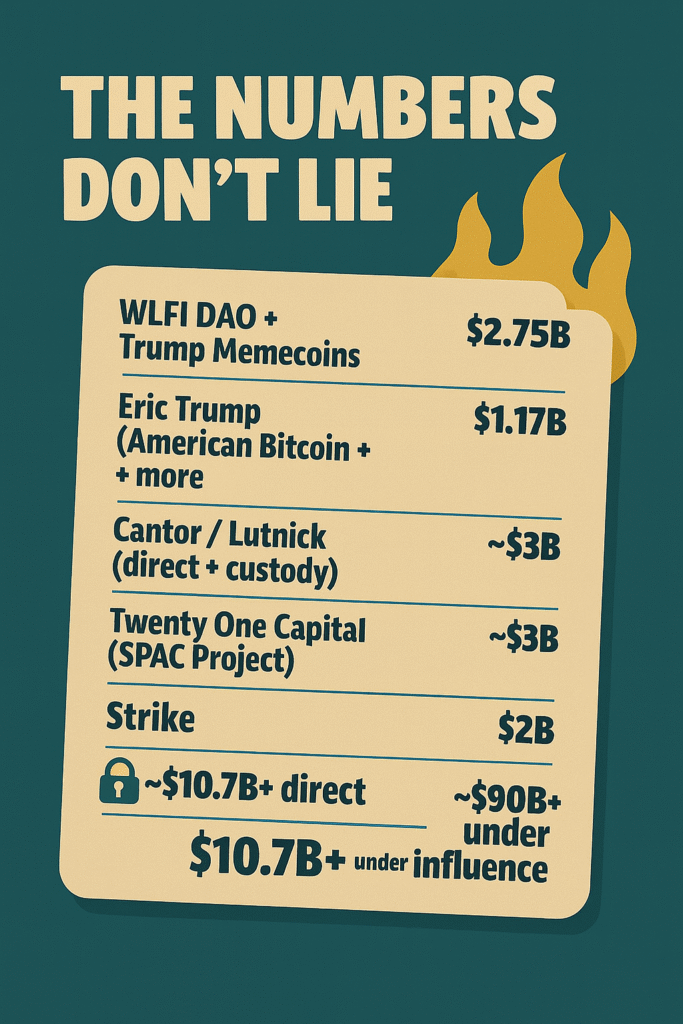

The $10.7 Billion Conflict

Let’s total it up:

$2.5B – World Liberty Financial raise

$3B – Twenty One Capital

$2B – Binance/UAE deal (via USD1)

$86B – Tether (custodied by Cantor)

$945M – Metaplanet BTC holdings (Eric Trump advisory)

$390M – Trump’s direct token comp

$10.7 billion in documented, overlapping interests between crypto policy and private profit — all touching the White House.

This isn’t about whether crypto is good or bad. It’s about whether the people making the rules are getting rich from the outcomes of those rules.

When your Commerce Secretary controls Tether, your Treasury Secretary pushes dollar devaluation while holding Bitcoin, and your President’s family is issuing stablecoins used in foreign capital flows…

At what point do we stop calling it coincidence?

Part 2 : We goin on a field trip to DC

Read up more about Tethers Regulatory woes and solutions Here

Get more instight into the Stable Coin business Here

© 2025 The Corn Report. All rights reserved.

This site is for educational and informational purposes only. Nothing here is financial advice. No guarantees. No endorsements. Just signal.

No paywalls. No clickbait. No bullshit.

Contact: admin@thecornreport.com