Bitcoin, Billionaires, and Birds Aren’t Real – Part 2

ACT I – The Fiscal Trap: How We Got Here

The 2008 financial crisis wasn’t fixed — it was refinanced.

To keep the system from imploding, the U.S. used short-term debt to bail out the banks, pump the markets, and buy time. That “temporary emergency fix” became permanent policy. Instead of paying off debt, we’ve been rolling it over. Every few years, we issue new debt to pay off the old debt — at higher interest rates — and pretend we’re still solvent.

That’s why there’s always a government shutdown headline every 4–5 years. It’s not about running out of money — it’s about refinancing maturing IOUs and pretending that’s sustainable.

As of 2025, the U.S. is rolling over $36 trillion in public debt. The Fed can’t cut rates without reigniting inflation. Congress can’t stop spending without collapsing the economy. We’re stuck. So now the only “solution” left on the table is to make the debt cheaper by devaluing the dollar itself.

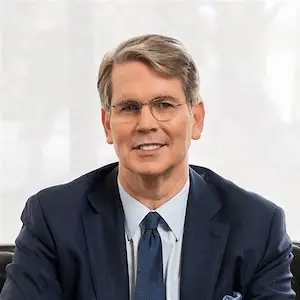

ACT II – Enter Scott Bessent: From Soros to Treasury (and Fed Chair Watch)

Scott Bessent isn’t just another political appointee. He ran Soros Fund Management’s London office in the early 1990s and helped pull off one of the most famous macro trades in history: shorting the British pound in 1992, which forced the UK out of the European Exchange Rate Mechanism and “broke the Bank of England.”

Later, as Chief Investment Officer at Soros from 2011–2015, he led the firm through another blockbuster — earning over $1.2 billion shorting the Japanese yen during the Bank of Japan’s monetary easing.

In January 2025, Bessent was sworn in as U.S. Treasury Secretary.

Now he’s also being floated as a potential replacement for Fed Chair Jerome Powell, whose term ends in May 2026.

Sources:

https://home.treasury.gov/news/press-releases/sb0001

https://www.thetimes.co.uk/article/scott-bessent-trumps-man-who-broke-the-bank-of-england-kn8nj2nrm

https://www.reuters.com/world/us/trump-administration-will-focus-fed-chair-replacement-fall-bessent-says-2025-07-03/

https://www.marketwatch.com/story/can-trump-tap-bessent-to-head-the-fed-and-the-treasury-at-the-same-time-heres-what-the-law-says-57ba1125

ACT III – Stephen Miran and the Dollar Reset

Stephen Miran is a former Treasury advisor and now one of the key policy architects behind Project 2025, the Heritage Foundation’s roadmap for the current administration.

He’s not vague about the plan.

In a 2024 Wall Street Journal op-ed, Miran explicitly called for a multi-year devaluation of the U.S. dollar, referencing a “New Plaza Accord” and even a “New Bretton Woods” as models to consider.

He labeled it a soft default — a way to reduce the real value of U.S. debt while boosting exports.

“We need a soft default via devaluation of the U.S. dollar. A new Plaza Accord should be on the table.”

— Stephen Miran, WSJ

He’s now working inside the administration’s economic transition team, with direct input on policy.

ACT IV – Trump’s Bitcoin Pivot

Trump isn’t campaigning anymore. He is the President. And his stance on Bitcoin has changed completely.

Back in 2021, he called it a scam. In 2024 and into his second term, he’s backing it publicly and privately:

“Bitcoin mining may be our last line of defense against a CBDC”

“All remaining Bitcoin should be made in the USA”

Pledged to pardon Ross Ulbricht

Hosted executives from CleanSpark and Riot Platforms at Mar-a-Lago

This pivot isn’t about ideology or tech. It’s strategic. If the U.S. is going to weaken the dollar, Bitcoin is the perfect hedge — it’s priced in dollars but independent of them. It soaks up monetary debasement and redistributes it into a global, non-sovereign ledger.

Sources:

https://www.coindesk.com/policy/2024/07/27/in-donald-trumps-own-words-a-partial-transcript-of-his-bitcoin-2024-speech

https://www.foxbusiness.com/politics/trump-backs-bitcoin-defense-against-foreign-adversaries-centralized-digital-currency

https://www.wsj.com/politics/elections/donald-trump-campaign-crypto-bitcoin-7a2e2e4f

ACT V – Infrastructure for the Transition

The shift in policy is already backed by real money and real rails.

Howard Lutnick – Secretary of Commerce

The former Cantor Fitzgerald CEO (His son took over)

Together they have:

Together they hold control over :

Tether

Controls the infrastructure for Tether’s $134B in Treasury reserves

Is in talks to launch a $2 billion Bitcoin-backed lending facility

Is publicly coordinating with mining and stablecoin partners

Twenty One Capital

Launched by Lutnick’s son. Seeded with 42,000 BTC from Tether and SoftBank.

Functions as:

BTC holding company

Digital asset infrastructure

Bridge between Wall Street and sovereign-aligned crypto access

Source:

https://www.ft.com/content/501210ad-d39b-4d7b-b649-bbd08ceffe6f

Combined Setup

Bessent at Treasury (and potentially Fed)

Miran laying out the policy roadmap

Trump directing the playbook from the top

Lutnick building out the rails

This isn’t theoretical. It’s already underway.

This isn’t about Bitcoin vs the Dollar.

And it’s not an exit ramp.

They know what they’re going to do — devalue the currency — and they know better than to hold cash when it happens. They hold assets that go up when the dollar goes down: Bitcoin, energy, equities, real estate. This isn’t guesswork. It’s positioning.

Bessent’s done it before.

Miran’s drawing the map.

Trump’s signing off.

Lutnick’s got the rails.

And you’re still wondering if the Fed will pivot.

This isn’t a hedge. It’s the trade.

And if any of that sounds too coordinated to be true, don’t worry — it’s probably just another conspiracy theory.

Because Birds Aren’t Real – They’re Government drones, and thats why they’re always on the power lines- to recharge…

or

This post is part of The Corn Report — a Bitcoin-first macro blog tracking the real moves behind the headlines.

No financial advice. No hopium. Just signal.

Don’t trust. Verify.

Sources:

https://www.coindesk.com/policy/2024/07/27/in-donald-trumps-own-words-a-partial-transcript-of-his-bitcoin-2024-speech

https://www.foxbusiness.com/politics/trump-backs-bitcoin-defense-against-foreign-adversaries-centralized-digital-currency

https://www.wsj.com/politics/elections/donald-trump-campaign-crypto-bitcoin-7a2e2e4f