This Isn't a Bubble — It's a Transition

Holy Shit Its Happening!!!

Bitcoin just tapped $122,000

— all-time high —

Meanwhile the only thing moving on crypto Twitter is Elon fapping to Grok in a reply thread nobody asked for.

The Alt-Coin market is pushing rope like it’s been on a 3-day bender. DeFi looks like an abandoned Blockbuster.

Your “normie” friends still think you’re in a pyramid scheme.

– No celebrating

– No rocket emojis.

– No teenagers buying the dip with their Wendy’s paychecks.

While Altseason bleeds out in the parking lot, Wall Street is quietly eating Bitcoin’s entire supply, one boring ETF purchase at a time.

Its not a bubble, its something else.

Where Is Everybody?

The truth is, outside our little crypto echo chamber — Twitter threads, Discords, Reddit degens — nobody gives a shit.

The average person isn’t trading from a gaming chair while ripping dab pens and yelling “buy the dip.”

They’re grinding. They’re tired. They’re staring at a grocery bill that went up 30% and wondering why lentils cost more than last month’s Comcast note.

That brief retail renaissance? It died somewhere between three rounds of layoffs and a canceled Netflix subscription.

People don’t have disposable income to throw into meme coins anymore. They’ve got rent, medication, and three Buy Now Pay Later tabs open.

Everyone is tapped out.

That’s why this market feels weird. It’s not dead — it’s quiet. Because the crowd that turns rallies into bubbles? They’re still standing in line at Costco pushing out that oil change till next check.

Meanwhile, Quiet Accumulation

While retail’s still trying to figure out how their Bi-Weekly Insult vanished by Tuesday, Wall Street’s been quietly eating their lunch.

No memes. No influencers. No Discord pump rooms. Just spot ETF filings, strategic buys, and a level of patience that only comes from managing someone else’s money.

They don’t care about Pi Cycle Indicators. They’re not waiting for Altseason. They’re buying Bitcoin — slow, steady, and without telling anyone.

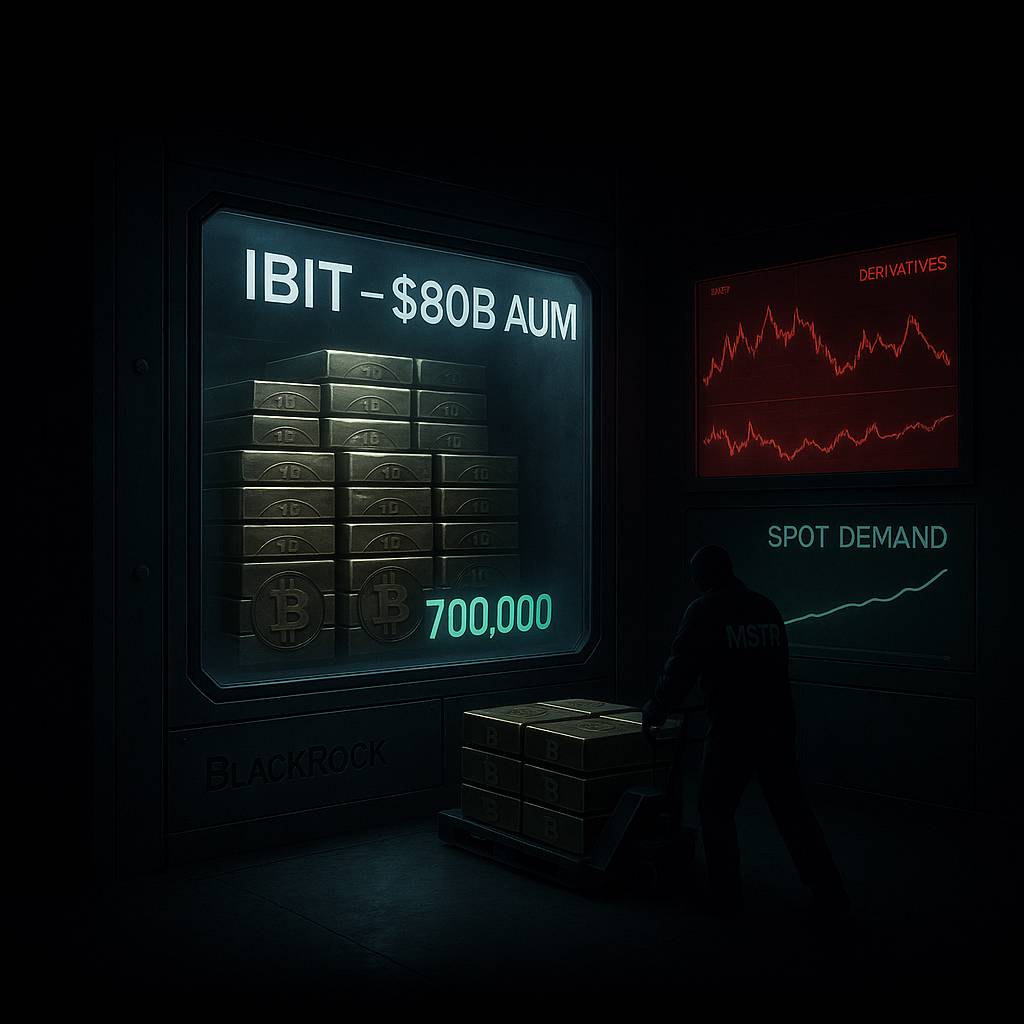

– IBIT (BlackRock) has surpassed $80 billion AUM in 374 days — the fastest-growing ETF in history.

– It holds over 700,000 BTC, representing 3.55% of the total supply.

– Daily inflows have topped $1 billion, over 20x the daily mined BTC supply.

– MicroStrategy (MSTR) holds 580,000 BTC ($63.5 billion), using zero-coupon convertible bonds and equity raises to acquire more. Total raised: over $4.25 billion.

– On-chain data shows coins flowing off exchanges into cold storage at historic rates.

– Derivatives dominate trading volume, spoofing volatility while real buyers stack.

Russian companies are using crypto and gold for cross-border payments amid sanctions.

Sberbank, Russia’s largest bank, launched OTC Bitcoin bonds for institutional investors.

The central bank now allows crypto derivatives for qualified investors.

Bhutan converted $750M in hydroelectric surplus into BTC reserves — ~28% of GDP.

The U.S. government holds ~200K BTC as part of its Strategic Bitcoin Reserve.

El Salvador continues to grow its sovereign BTC holdings (6,000+ BTC).

India leads the world in crypto adoption by user count.

Indian financial authorities are evaluating Bitcoin as a strategic hedge.

BRICS leaders are openly discussing digital asset integration and non-dollar settlement.

Big players are accumulating without fanfare or tweets.

Bitcoin is becoming a strategic reserve asset for institutions and states alike.

This isn’t a bubble. This is the world moving off the dollar — one coin at a time.

Wall St. has the scent

IBIT is stacking billions and outperforming BlackRock’s S&P fund. MicroStrategy can’t issue Bitcoin-backed bonds fast enough. Supply is shrinking. Demand is institutional.

All while retail’s still waiting for a Coinbase outage like it’s a bat signal. There is no signal. Just a vacuum — where Bitcoin disappears off exchanges and reappears in vaults you’ll never see.

Bitcoin is now the #6 most valuable asset on Earth, with a market cap of $2.3 trillion

— neck-and-neck with Amazon and worth more than the GDP of Canada.

Is it a Ponzi scheme?

– If it is, it’s the first Ponzi that outranked Berkshire Hathaway and got ETF approval from BlackRock.

This isnt a bubble

And It’s not too late.

And no — it’s not going to zero.

Retail didn’t send it to here.

Retail creates bubbles — they show up loud, late, and leveraged, stretch the market ‘til it snaps, then swear off crypto forever.

What we’re seeing now?

That’s not retail behavior.

That’s institutional allocation — slow, boring, strategic.

It’s not DeFi casinos or TikTok traders.

It’s asset managers with 30-year horizons and SEC filings.

Altcoins are bleeding out because retail isn’t here.

Bitcoin keeps stepping up because institutions are — and they don’t give a shit about yield farming or JPEG monkeys.

Nothing stopping us from joining them.