The Secret Buyers: How Stablecoins Became a Shadow Bond Market

So I guess its important that we just clear the air about stablecoins…

Yes, it’s the digital dollar thats pegged to the USD. Its also a mechanism for billions in Treasury buying with none of the transparency or regulation you’d expect from, you know, something that affects the entire global financial system.

Stablecoins: Stable for you, revenue generating for them

Let’s start with the advertisement. What the retail public are sold: ‘Revolutionary digital cash!’ that magically solves every banking problem — instant global transfers, no weekend delays, pennies in fees instead of $50 wire transfers, and all the stability of the dollar without the volatility of ‘real’ crypto. It’s the perfect product for people who want to feel like financial rebels while still basically using dollars. Crypto for people who don’t actually want crypto.

But behind that digital dollar there’s more.

Nothing’s free and Tether didn’t build a $110 billion empire out of kindness. You’re paying them cash, they’re earning a dividend. Every dollar you deposit becomes a Treasury bill yielding 5%+ while you get a digital IOU that pays zero. It’s the most elegant scam in finance — convince millions of people to give you interest-free loans so you can buy the safest bonds on earth and pocket billions in yield.

This isnt tech disruption, its a basic bond strategy with a cool suit, but wearing sneakers...

Why the U.S. Loves This Setup

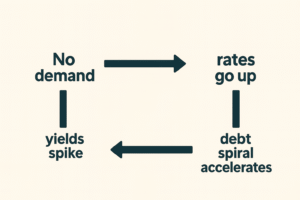

The government needs buyers for its debt-Desperately- and foreign nations are backing away. The Fed is boxed in. Domestic banks are already bloated with Treasuries. So who’s left -Stablecoins

– Never complain

– Always hungry

– Don’t care about politics, inflation, or deficits

These crypto-dollar hybrids are the perfect buyers.

They just want “safe yield and fat margins”. And the Treasury? It’s happy to hand it over, because the last thing it wants is a failed bond auction.

Lets spin this another way.

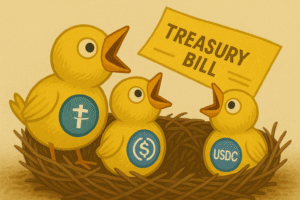

1. Someone buys USDC → sends $100 to Circle

2. Circle buys a 1-month Treasury bill

3. U.S. government gets funded

4. You now have a crypto dollar — but the real money is in Washington

"That's Quantitative Easing — just privatized..."

The stablecoin isn’t just a token. It’s a wrapper for a bond being exported globally, 24/7, outside the U.S. banking system. And here’s the risk nobody talks about: stablecoins aren’t just a crypto thing anymore — they’re quietly holding up part of the entire U.S. debt market. If stablecoins lose demand (crypto crashes, faith wobbles, whatever), the buying pressure on Treasuries disappears. Billions can unwind overnight.

What started as digital cash has become an unregulated pillar of government financing. When the peg breaks, so does the bond market.

Welcome to 2025, where ‘disrupting finance’ means reinventing government bonds with extra electricity costs and a Discord channel.

This digital revolution will be fully backed by the most analog thing on earth: Uncle Sam’s IOUs.

🔗 Related Profiles:

– Howard Lutnick https://thecornreport.com/bios/howard-lutnick/ — Manages Tether’s Treasury reserve empire via Cantor Fitzgerald

– Stephen Miran https://thecornreport.com/bios/stephen-miran/ — Treasury strategist behind engineered debt demand

– Scott Bessent https://thecornreport.com/bios/scott-bessent/ — Soros-trained tactician profiting from fiat and bond instability

© 2025 The Corn Report. All rights reserved.

This site is for educational and informational purposes only. Nothing here is financial advice. No guarantees. No endorsements. Just signal.

No paywalls. No clickbait. No bullshit.

Contact: admin@thecornreport.com