The GENIUS Act, Tether's $90B Problem, and the Rise of TwentyOne Capital

Congress is about to fix stablecoins. You know, for your protection. Because nothing says “consumer safety” like a bill that essentially tells Tether: “Hey, that $90 billion you’ve been printing with God-knows-what backing it? Yeah, that’s gotta stop. But good news! We’ve got Howard Lutnick’s kid waiting in the wings with a shiny new Delaware LLC to do the exact same thing — just with better paperwork.”

The GENIUS Act sounds like reform. It’s actually a hostile takeover disguised as regulation. It isnt shutting down the stablecoin casino. They’re just… changing management.

The GENIUS Act: A Compliance Trap Disguised as Consumer Protection

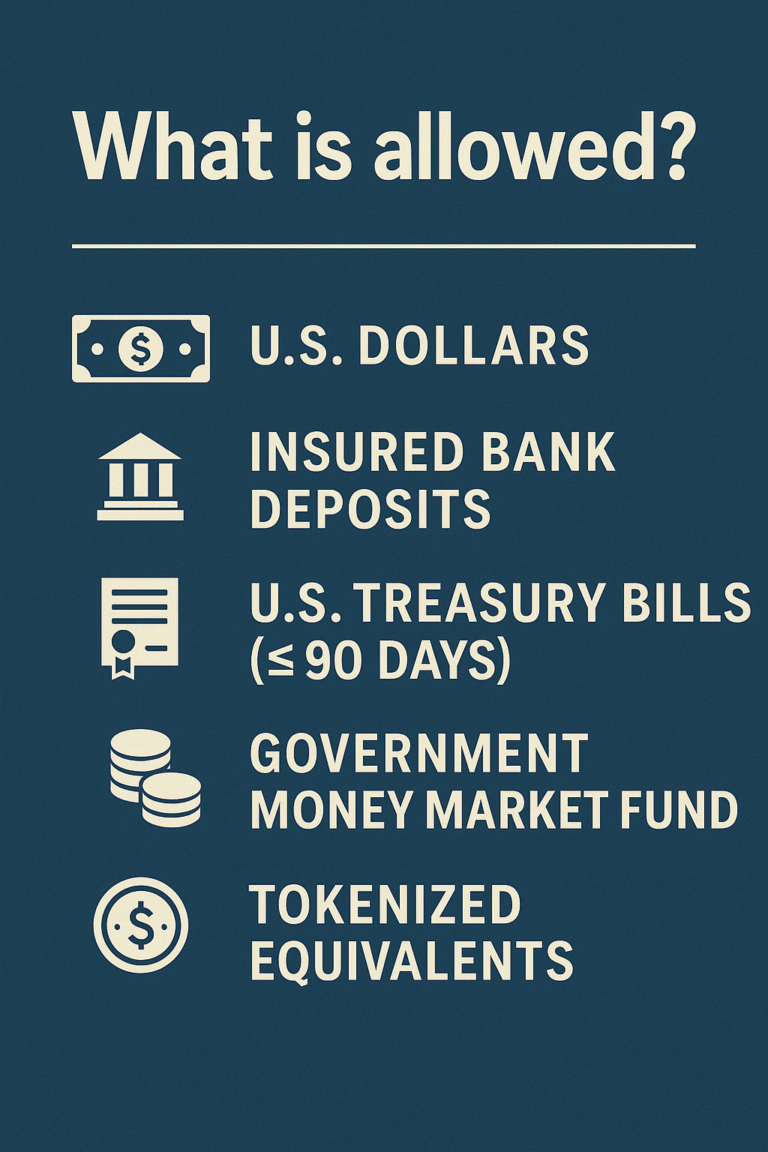

It creates a nice, legal framework for issuing dollar-pegged tokens. Very reasonable. Very measured. Your stablecoin just needs to be backed 1:1 with “risk-free, dollar-based assets.” You know:

Translation: You want to print digital dollars in America? You better be buying American debt.

It’s almost like they designed this specifically to benefit… someone who’s really good at buying Treasuries. Wonder who that could be?

Tether's $90 Billion Headache

Here’s where it gets fun. Tether has spent years operating offshore with reserves that were, let’s say, “creatively managed.” But recently? They’ve been shouting about their $90+ billion in U.S. Treasuries like they’re running for class president.

See, Tether knows this regulation is coming. They know their offshore shell game doesn’t survive a compliance audit. So they’ve been frantically buying American debt, hoping to look respectable when the music stops.

They just spent years playing Sisyphus with Treasury purchases, and the boulder’s about to roll right back down the mountain.

- Isn’t a U.S.-based issuer

- Doesn’t meet the GENIUS Act’s audit requirements

- Doesn’t fall under U.S. regulatory jurisdiction

So when this bill passes, Tether gets two choices:

- Exit the U.S. market entirely

- Create a U.S.-compliant front company

Enter TwentyOne Capital: The Obvious Plant

Oh look! Right on cue, here comes TwentyOne Capital. Backed by Howard Lutnick (Cantor Fitzgerald) and Jack Mallers (Strike). What a coincidence!

Let’s see… Lutnick’s firm already custodies Tether’s Treasuries. Lutnick just became Commerce Secretary. Strike is perfectly integrated with U.S. payment infrastructure. And now they’ve got a brand-spankin new compliant stablecoin structure ready to go.

If this were any more obvious, they’d have to file it under comedy

You’ve got Tether — the $90 billion offshore money printer that can’t survive regulation. And you’ve got TwentyOne Capital — the squeaky-clean domestic operation that checks every regulatory box.

Think of it as: Tether = the offshore liquidity engine. TwentyOne = the compliant storefront for American customers.

They’re not losing the U.S. market. They’re rebranding it.

Free Money for the Chosen Few

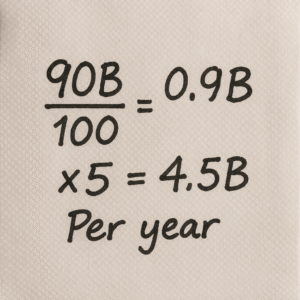

But wait, there’s more! Under the GENIUS Act, compliant issuers get to keep the interest from their Treasury holdings.

So let’s do the math: You issue tokens pegged to $1. You back them with Treasuries earning ~5%. On $90 billion, that’s $4.5 billion per year in pure profit.

Meet America’s real welfare queens. Congress can’t find money for your healthcare, but they’ve got $4.5 billion annually to hand out to the Treasury Secretary’s company.

And who gets to play? The firms that were smart enough to position themselves as “compliant” before the rules got written. You know, like TwentyOne Capital and Trump’s World Liberty (USD1).

The Bottom Line

This isn’t regulation. It’s a corporate succession plan.

They’re not fixing the stablecoin problem. They’re just making sure the right people profit from it. Tether built the infrastructure, took all the heat, and proved the demand. Now the connected players get to inherit a cleaned-up version of the same racket.

The public thinks they’re getting consumer protection. The industry thinks they’re getting regulatory clarity.

Tether spent years building a $90 billion empire while operating in regulatory gray areas. TwentyOne Capital gets to inherit that empire with a government stamp of approval.

And they’re doing it with your tax code.

← Back to Home | View All Blogs

Disclaimer: This post is for educational purposes only and does not constitute financial or investment advice. The Corn Report is an independent publication offering analysis and opinion on Bitcoin, policy, and macroeconomic trends. Always do your own research.