The Patriot Yield Machine : Boring Like Banking - Criminal Like Politics

Welcome to the Patriot-Yield factory tour, folks!

Please keep your hands and wallets inside the vehicle at all times. I’m your guide today, and I used to think the most cynical thing I’d ever see was a gas station sushi display, but then I discovered how Donald Trump accidentally became the world’s most successful cryptocurrency operator while calling Bitcoin “a scam” for six years. Today we’re going to walk through the entire assembly line – from the World Liberty Financial meme coin distraction factory, through the USD1 stablecoin yield-farming operation, all the way to the shiny new Truth Social ETF showroom where red-blooded Americans can finally buy a “patriotic” Bitcoin fund.

Think if it like Willy Wonka’s chocolate factory, except instead of Oompa Loompas, we have SEC commissioners, and instead of golden tickets, we have…

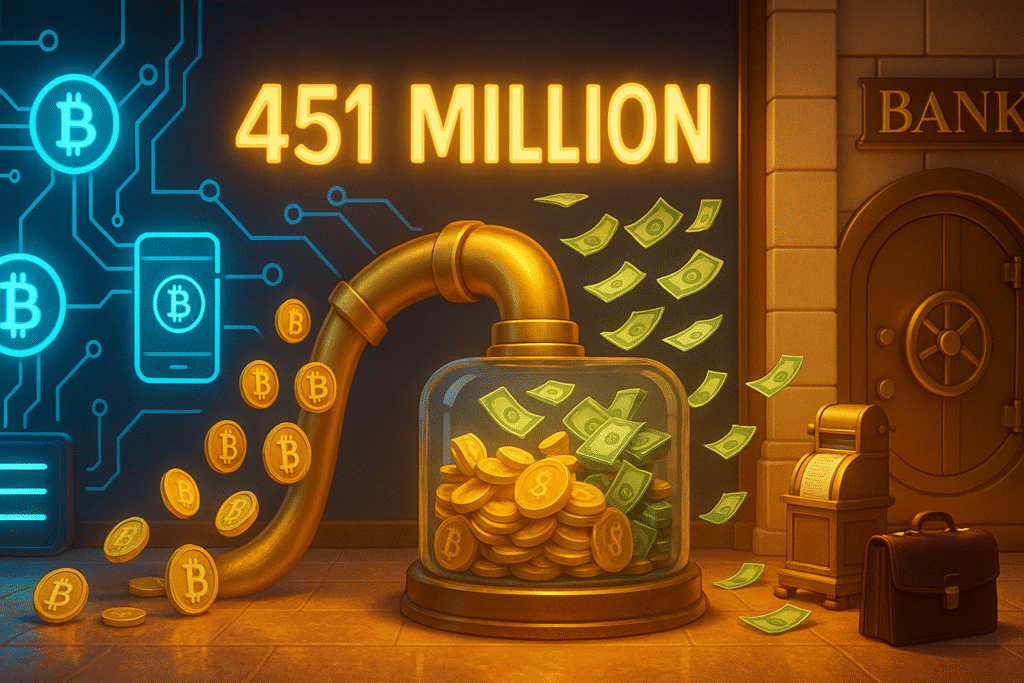

well, actual golden tickets – that somehow generate $451 million a year.

Stop One : The Meme Coin Distraction Ward

First stop on our left: the $TRUMP meme coin production facility. Now, you might think launching a cryptocurrency named after yourself while being President is ethically questionable – and it is – but it’s also ethically hilarious. – Watch as retail investors frantically buy digital tokens thinking they’re supporting democracy, while the exchanges quietly collect $349 million in trading fees.

It’s like a casino, except the chips have the President’s face on them and somehow that makes it patriotic.

The beautiful part? Whether $TRUMP goes to $100 or $0.01, Coinbase and Binance get paid on every transaction.

The exchanges are essentially paid stagehands holding up the curtain – they provide the noise, the legitimacy, the firewall between “meme coin chaos” and “serious business operations.”

Did ya notice how Coinbase fast-tracked this listing in 72 hours? That’s because Trump doesn’t just drive crypto volume – he drives all volume. Traditional finance, crypto, options, everything. The exchanges aren’t just taking their cut – they’re getting a traffic boost across their entire platform. It’s the financial equivalent of booking a controversial comedian: sure, some people complain, but everyone’s buying tickets.

Stop Two : The USD1 Stablecoin Engine Room

Now let’s head deeper into the factory, past the gift shop selling “HODL Liberty” t-shirts, to the real money-making operation: the USD1 stablecoin facility.

This is where the magic happens, folks. See, while everyone’s distracted by the fireworks show out front, the actual business is running a shadow central bank.

USD1 is pegged 1:1 to the dollar, backed by real Treasury bonds, and custody is with BitGo. So when you buy USD1 for “stability,” your cash goes into 1-year Treasuries earning 5%+.

You get digital dollars. They get the yield.

Think of it like a savings account where the bank keeps 100% of the interest and calls it a “service.”

With $2 billion already parked in this system, that’s over $100 million per year in Treasury interest flowing directly into the operation.

– The customers think they’re buying digital cash.

– The Treasury Department thinks they’re selling bonds to patriotic Americans.

– Everyone’s happy,

except nobody told the customers they’re providing free loans to fund the next phase of the operation.

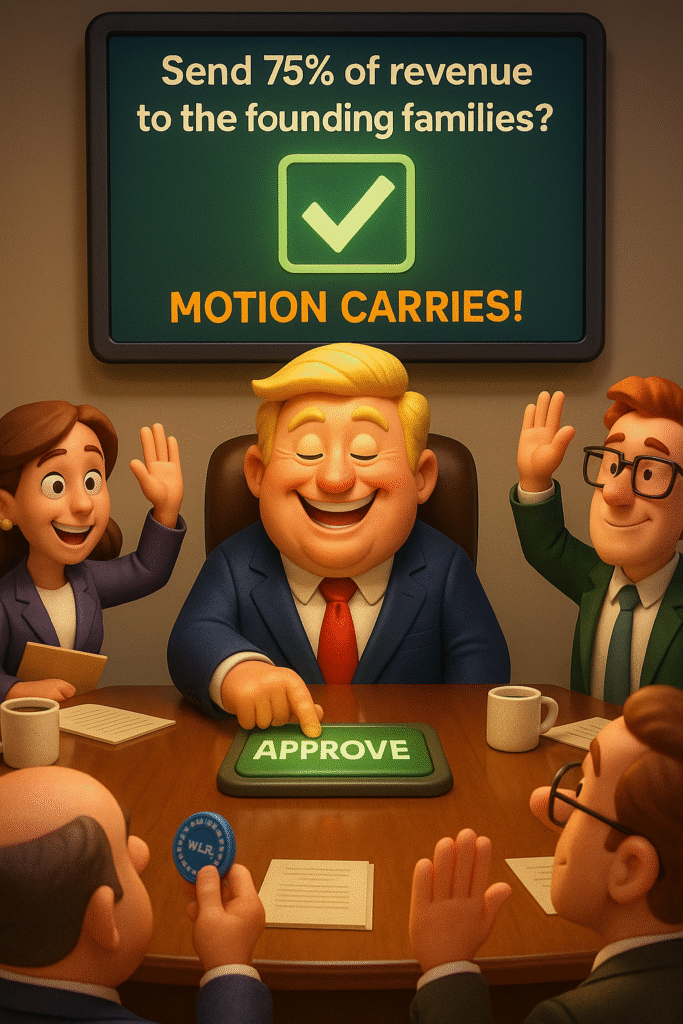

Stop Three : The WLFI Token Governance Theater

Next we enter the “Governance” wing, where democracy goes to die.

Here’s where they mint WLFI tokens and tell retail investors they have a “voice” in this decentralized financial revolution.

It’s like those town halls where residents get to “vote” on the new Walmart location- except Walmart already owns the land, the mayor, and 60% of the voting machines.

The Trump family controls the majority stake, but they’ve thoughtfully allowed the public to buy tickets to watch the decision-making process. You can almost hear the voting:

a

b

Meanwhile, token holders get to debate crucial governance issues like whether the logo should be more patriotic red or freedom blue.

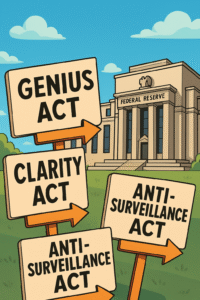

Stop Four : The Regulatory Arbitrage Workshop

Over here we have my personal favorite exhibit: the Regulatory Arbitrage Workshop, – where laws are more like… suggestions.

Foreign investors can pour money into WLFI without triggering campaign finance laws because it’s not technically a political donation – it’s a “governance token purchase.” The Treasury Department loves selling bonds to the stablecoin operation because it looks like organic demand from patriotic Americans.

Watch as our skilled craftsmen navigate the beautiful maze they helped design!

The GENIUS Act keeps the Fed out of stablecoin oversight – whoops, guess they can’t regulate USD1.

The CLARITY Act puts crypto under friendly state regulators instead of those pesky federal agencies.

And the Anti-Surveillance Act? It banned public CBDCs, which conveniently leaves the field wide open for private stablecoins.

Foreign investors can pour money into WLFI without triggering campaign finance laws because it’s not technically a political donation – it’s a “governance token purchase.”

The Treasury Department loves selling bonds to the stablecoin operation because it looks like organic demand from patriotic Americans.

Stop Five : The Traditional Finance Bridge

And here’s where things get really sophisticated, folks

The Traditional Finance Bridge, where we take all this beautiful crypto chaos and make it palatable for people who still write checks.

See, the meme coins and governance tokens are fun, but the real money is in making Grandma’s financial advisor comfortable.

Enter the ETF suite:

We’ve got the Truth Social Crypto Blue Chip fund, a dual BTC/ETH offering,

-And coming soon-

The “Made in America” patriotic investment strategy

It’s the same assets, the same volatility, but now it comes with a prospectus and FINRA approval.

The beauty is cross-promotion:

– Truth Social users become investors,

– Investors become Truth Social users

– And everyone gets funneled through the same revenue ecosystem.

-We’re not just selling crypto-

We’re selling lifestyle-branded financial products to people who think buying American means nothing more than checking where their truck was assembled.

Stop 6 : Back to the Lobby

And that concludes our factory tour, ladies and gentlemen!

Let’s tally up the receipts, shall we?

The meme coin generates $349 million annually in exchange trading fees

Coinbase and Binance get their cut, we get the volume and cultural momentum.

The USD1 stablecoin operation pulls in over $100 million per year just from Treasury yields on customer deposits.

The ETF suite? Every billion in assets generates $7.5 million annually in management fees, forever.

Add it all up and we’re looking at $451 million per year in current revenue, scaling to over $1.2 billion annually within five years.

Thats not just extracting fees – we’re accelerating the infinite money supply machine.

Every dollar that flows through our stablecoin creates demand for Treasury bonds, which funds government spending, which creates more dollars, which drives more people toward “hard assets” like Bitcoin And that pumps our holdings.

We’ve monetized patriotism, tokenized rebellion

– Don’t forget to stiff your wait staff.

Sources:

Reuters – Trump-linked crypto firm says it will launch stablecoin

https://www.reuters.com/technology/trumps-world-liberty-financial-crypto-venture-says-it-will-launch-stablecoin-2025-03-25/Reuters – WLFI stablecoin used in $2B investment from Abu Dhabi MGX into Binance

https://www.reuters.com/world/middle-east/wlfs-zach-witkoff-usd1-selected-official-stablecoin-mgx-investment-binance-2025-05-01/Reuters – Trump family controls 60% of WLFI, received ~75% of revenue

https://www.reuters.com/business/finance/how-trump-family-took-over-crypto-firm-it-raised-hundreds-millions-2025-03-31/Reuters – Aqua 1 (UAE) buys $100M in WLFI

https://www.reuters.com/press-releases/aqua-1-announces-100m-strategic-world-liberty-financial-governance-token-purchase-to-help-shape-and-accelerate-decentralized-finance-adoption-2025-06-26/Business Insider – Trump Media doubles down on crypto with new ETF

https://www.businessinsider.com/trump-media-djt-crypto-president-bitcoin-ether-etf-btc-eth-2025-6Reuters – NYSE Arca submits filing to list Truth Social Bitcoin ETF

https://www.reuters.com/business/nyse-arca-submits-filing-listing-truth-social-bitcoin-etf-2025-06-03/Cinco Días (El País) – Truth Social Crypto Blue-Chip ETF filing

https://cincodias.elpais.com/criptoactivos/2025-07-08/trump-media-redobla-su-apuesta-por-las-criptos-con-un-nuevo-etf-de-activos-digitales.htmlWVTM13 – Trump meme coin drives $349M in trading volume

https://www.wvtm13.com/article/donald-trump-crypto-etf-sec-guidelines/65337618