Why Smart Companies Like MicroStrategy Are Swapping Bonds for Bitcoin

We’re going long on this one. But when billion-dollar firms are flipping fiat for Bitcoin, you probably want to know why.

This will be digestible. Tad brutal, but we might just save your retirement.

We’ve talked about the debt crisis. We’ve talked about why U.S. Treasuries are hot garbage. – What are you gonna do? — if you’re a fund manager or running a multinational corporation, you can’t just sit in cash watching it melt into toilet paper. And you sure as hell can’t park billions in Treasuries, which are basically IOUs from a broke government.

So where do you go?

Corporate bonds. Just like retail investors want out of dollars and into real assets, so do the big boys. But they can’t all pile into real estate or commodities. Corporate bonds? That’s backing actual businesses — companies that make things, sell things, generate cash flow. It’s not a government IOU. It’s a stake in something real.

The Corporate Shift

Bitcoin isn’t just for retail speculators or crypto bros anymore. It’s on the balance sheets of billion-dollar firms. From Tokyo to Tysons Corner, CFOs are waking up to the same realization: government bonds no longer preserve value. Michael Saylor put it best: “Cash is trash.” And in a world drowning in debt, the smart money is opting out.

What's Wrong With Bonds?

U.S. 10-year yield: ~4.3%

CPI inflation: ~3.5%–4.0% (and that’s the official number)

Real yield: Effectively zero — or worse

Let’s call it what it is: bonds are broken. Inflation is running hotter than yields, meaning every year you hold bonds, you’re losing purchasing power. Even so-called “safe” Treasuries now come with political risk, inflation risk, and rollover risk.

And it’s not just the U.S. Japan and Europe have their own bond-market dumpster fires: weak currencies, bloated central banks, and aging populations. Buying bonds in this environment is just locking in a loss.

Bitcoin as a Bond Alternative

Bitcoin doesn’t just flip the script. It rewrites the whole damn playbook. It’s scarce, decentralized, and immune to political manipulation. Unlike bonds, it doesn’t rely on someone else paying you back.

* Fixed supply: 21 million coins, ever

* Global liquidity: trades 24/7, everywhere

* No counterparty risk

* Increasingly held by public companies, sovereign wealth funds, and family offices

It’s digital property in a world of depreciating promises.

Microstrategy:

Michael Saylor’s firm is the blueprint. Since 2020, MicroStrategy has aggressively accumulated Bitcoin using convertible debt, cash flow, and equity raises.

– As of June 30, 2025, MicroStrategy holds 597,325 BTC

– Total cost basis: ~$39.7 billion

– Average purchase price: ~$66,385 per BTC

– This makes them the largest corporate holder, controlling nearly 2.84% of the total Bitcoin supply

Metaplanet

In Japan, Metaplanet is running the same playbook — but with a twist: they’re exploiting the yen-dollar carry trade.

Here’s how it works:

Borrow yen at near-zero rates, convert it to dollars, buy Bitcoin. As the yen weakens, their debt shrinks — and Bitcoin grows. Simple. Ruthless.

* Japan has near-zero rates

* U.S. Treasuries yield over 4%

* Bitcoin denominated in dollars protects against yen debasement

It’s a double play: they’re betting against their own currency while front-running both Japanese money printing and global Bitcoin adoption. Metaplanet is basically saying: “Why hold government bonds when we can front-run inflation and currency collapse?”

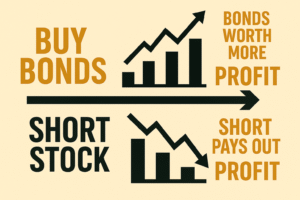

This is my favourite part! Wanna know how hedge funds turned MicroStrategy into a money printer?

Hedge Funds buy the convertible bonds and short the stock simultaneously, creating a “delta neutral” position that profits from price swings whether MSTR goes up, down, or sideways. As MSTR’s stock moves, they constantly adjust their positions—buying more as it rises, selling as it falls—capturing the spread on every swing. With MSTR’s insane 5.2% daily volatility (versus 0.6% for the S&P 500), these “gamma trades” generate massive profits from pure mathematical arbitrage. One hedge fund made $118 million from a single MSTR position just by harvesting volatility. They don’t care if Bitcoin goes to $200k or $20k—they’re getting paid every time the price moves. It’s like running a casino where you profit from the gambling action itself, not the outcome. And every dollar they make creates more demand for MSTR bonds, giving MicroStrategy more capital to buy Bitcoin, which increases volatility, which generates more hedge fund profits. It’s a perpetual motion machine powered by math, not speculation.

Why This Matters to You

Look — if trillion-dollar companies are dumping bonds for Bitcoin, it’s not because they suddenly got religion about “digital gold.” It’s because they did the math and realized the traditional financial system is fucked.

While you’re still worried about your 401k allocation, they’re quietly building lifeboats.

The bond market is broken. The dollar is getting debased into oblivion. And the only people still buying Treasuries are stablecoin issuers and the Fed buying its own debt like some financial ouroboros.

So here we are:

Corporate America is opting out, one balance sheet at a time.

They’re not coming back to save you.

They’re not asking for permission.

They’re not waiting for collapse. They’re front-running it.

© 2025 The Corn Report. All rights reserved.

This site is for educational and informational purposes only. Nothing here is financial advice. No guarantees. No endorsements. Just signal.

No paywalls. No clickbait. No bullshit.

Contact: admin@thecornreport.com